In this article, we will explain the different types of pensions and the requirements to receive them.

Written by Albert Perez

Labour lawyer

See more

ORDINARY RETIREMENT

The beneficiaries of this retirement plan are persons included in the 'Régimen General', affiliated and registered or in a situation assimilated to that of registration, who meet the requirements established by law.

Retirement in spain

Albert Perez, Labour lawyer

How to define registration and identify situations considered equivalent in the context of retirement

Registration occurs when an administrative act initiates a legal relationship between the worker and Social Security. This relationship can begin with either an employee or a self-employed worker.

Situations Considered Equivalent to Registration According to Social Security:

- Legal Unemployment and Involuntary Unemployment: After exhausting contributory or assistance benefits, provided the individual remains registered as unemployed at the employment office.

- Unused Annual Paid Leave: During the period corresponding to annual paid leave not taken before the termination of the contract.

- Mandatory Leave of Absence.

- Exceeding Leave for Family Care: The period exceeding the effective contribution period considered in Article 237 of the General Social Security Law (LGSS) for caring for a child, foster child, or other relatives.

- Employee Transfer Abroad: When the employer transfers the worker outside the national territory.

- Special Agreement Subscription: In its various forms.

- Periods of Inactivity Between Seasonal Jobs.

- Imprisonment Periods: Resulting from situations covered under Law 46/1977 of October 15, on Amnesty, regulated by Law 18/1984 of June 8.

- Receipt of Early Retirement or Pre-Retirement Aid.

- Temporary Disability: As long as the individual remains in this situation after the contract has been terminated.

- Extension of Temporary Disability Effects.

- Maternity or Paternity: Continuing after the termination of the employment contract or starting during the receipt of unemployment benefits.

- Artists and Bullfighting Professionals: Days considered as contributions within each calendar year under the rules regulating their contributions, even if they do not correspond to days of service (also used to complete the minimum contribution period required, to determine the percentage, and to calculate the regulatory base).

- Workers Affected by Toxic Syndrome: Those who ceased their labor or professional activity due to this cause and could not resume it, provided they were registered in any Social Security system regime at the time of cessation. The equivalent situation will apply concerning the regime in which the worker was registered when they ceased their activity and for common contingencies.

- Suspension of Employment Contract: Due to a worker being forced to leave their job as a result of being a victim of gender-based violence.

What are the REQUIREMENTS FOR RETIREMENt

Requirements for Ordinary Retirement

Having established that being in an active or equivalent registration status is necessary to qualify for ordinary retirement, let's examine the specific requirements for receiving this benefit:

Age

The current retirement age is 65 years, provided there is a minimum contribution of 37 years and 9 months. If this minimum contribution period (37 years and 9 months) is not met, the retirement age is extended to 66 years and 4 months.

Minimum Contribution Period

To qualify for retirement, a minimum contribution period of 15 years is required, with at least 2 of these years falling within the 15 years immediately preceding the retirement date.

For part-time workers, the minimum contribution period of 15 years also applies. In calculating this period, only the days contributed will be considered, and these will be added to the days the worker has worked full-time.

VOLUNTARY EARLY RETIREMENT

Early retirement is when a worker chooses to retire before reaching the standard retirement age. To qualify for early retirement, one must be in:

- An active employment status with Social Security

- An equivalent status to active employment

These two conditions are explained in the section above on ordinary retirement and remain unchanged for early retirement.

Requirements for Early Retirement

Age Requirement

You must be at least 63 years old, which is up to 2 years younger than the required age for ordinary retirement.

Minimum Contribution Period

A minimum of 35 years of effective contributions is required, with at least 2 of those years contributed within the last 15 years preceding the retirement date.

PENSION AMOUNT

In the case of early retirement, the pension amount is reduced for each month the worker retires before reaching the legal age of 65. This reduction can never exceed 0.50% per quarter of early retirement, applied to the maximum pension amount.

At Conesa Legal, we are experts in retirement planning with over 15 years of experience in the field. We are dedicated to answering your questions, conducting the necessary retirement studies, and handling the process to help you start enjoying your well-deserved retirement.

INVOLUNTARY EARLY RETIREMENT

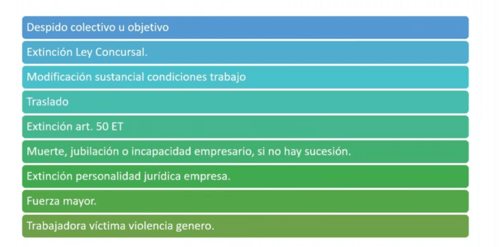

Involuntary early retirement occurs when a worker opts to retire before reaching the standard retirement age due to being affected by one of the following situations leading to the termination of their employment relationship:

To qualify for involuntary early retirement, you must be in one of the following:

- An active employment status with Social Security

- An equivalent status to active employment

These two conditions are explained in the section above on ordinary retirement and remain unchanged for involuntary early retirement.

REQUIREMENTS FOR RETIREMENT

Age Requirement

You must be at least 61 years old, which is up to 4 years younger than the required age for ordinary retirement.

Minimum Contribution Period

A minimum of 35 years of effective contributions is required, with at least 2 of those years contributed within the last 15 years preceding the retirement date.

Documents for Retirement Studies

Please prepare the following documentation so we can help you:

- Updated work-life (vida laboral) report.

- Updated contribution bases report.

- Copy of your Spanish ID (DNI/TIE).

- Copy of your employment contract (to determine the applicable collective agreement).

- Indicate if you have contributed abroad, and specify the country.

- Address.

- Mobile contact number and email.

- Marital status: married, single, divorced, etc.

- Spouse's details: name, surname, ID (DNI/NIE), date of birth.

- Children's details: name, surname, ID (DNI/NIE), date of birth.

- Details of cohabitants, if any: name, surname, ID (DNI/NIE), date of birth.

- Effective date of retirement.

- Income received from sources other than employment.