Written by Josep Conesa

Labour and bankruptcy lawyer

As an international law firm in Barcelona made up of professionals in related legal issues, we know that the experience of creating a company in Spain is one which benefits from an investment in sound, professional advise.

It is with that in mind that we present to you a complete analysis of the principal obligations of a Spanish company, from its constitution to its fiscal, contractual and employment obligations.

how are SPANISH CORPORATE COMPANies formed?

-

do you already have a company within europe whose activity you want to expand to spain?

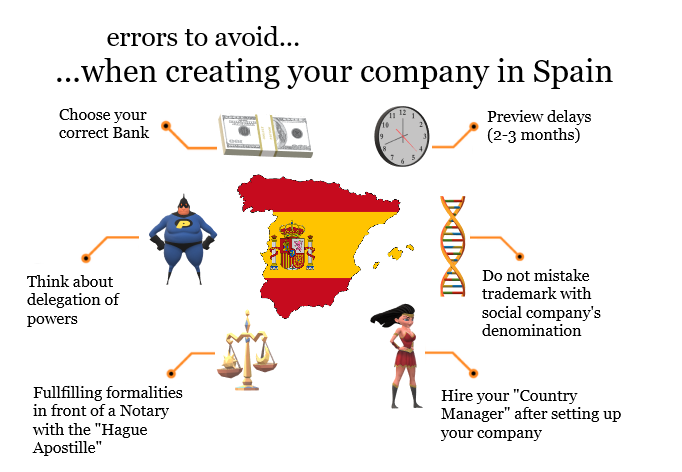

In this case, the first bureaucratic stage consists of authenticating certain documents, either by means of a notary or the Spanish consulate, and legalising them with an apostille. The Spanish administration will need the company’s bylaws to be authenticated and apostilled.

The director (known as the "administrador" in Spanish) of the company must also be identified by the Spanish Ministry of Internal Affairs who will assign a foreign identification number (N.I.E.) to any person who will reside for more than 3 months in Spanish territory, even if he or she will only perform some activities within Spanish territory.

For this reason, the original copies of the N.I.E. and foreign identity document (such as a passport) of the shareholder(s), if they are natural persons, must also be presented.

However, bearing in mind the type of activity to be carried out and the market situation in Spain, we are also able to advise you on the possibility of registering as a freelancer ("autónomo" in Spanish), a popular choice in Spain.

BRaNCH, PERMANENT ESTABLISHMENT OR COMPANY

"Check out our post about branches, permanent establishments and companies."

-

Which steps must be taken to officially form your company?

The incorporation process takes an average of 2 to 3 months given that each public administration has its own timeframes for managing registration applications and documentation requests.

The minimum steps to completed are as follows:

-

Applying for the negative certificate of the company's name, a document which certifies the uniqueness of the name you have chosen for your company.

-

The choice of the company name is a key step. Even if you already have a trademark registered at the European level, the Spanish Commercial Registry (Registro Mercantil) is in no way obligated to validate this business name. We advise you to prepare a list of 5 names, ranked in order of preference, so that there is more chance of one of your choices being available.

-

-

Applying for a tax identification number for the company (N.I.F.). You will need to use this identification number when carrying out almost any company activity or official procedure (preparing invoices, declaring taxes, carrying out Human Resources tasks, etc).

-

Signing the Deed of Incorporation at a Notary's office, in the presence of the shareholders and administrators. Once signed, the Deed of Incorporation must be registered at the Commercial Registry responsible for the region in which the company has its address, and, as such, the following information will be made publicly available:

-

Identification of the shareholders.

-

Company type: This could be an anonymous corporation, a limited liability company, a professional limited liability company, a community of property, etc.

-

The contribution to the capital: Distribution, value and number of shares, bearing in mind the minimum amounts set out in law (€3,000 for a limited liability company or €60,000 for an anonymous corporation).

-

The composition of the board of directors: Depending on how this is regulated by the company's Articles of Association/Bylaws, there are several alternatives (management by a single director, several directors with solidary or joint management, board of directors, etc).

-

Identification of the person who will initially take charge of the administration and the social representation of the company.

-

Company Articles of Association/Bylaws: Corporate name, corporate purpose (determining the corresponding activity of the company), registered address, share capital, details of the shares, means of organisation of the administration, means of deliberation and adoption of the minutes of the board of directors and shareholders, etc.

-

Once the incorporation procedure has been completed and the company has been registered in the Commercial Register, it's important to carry out some additional steps to ensure that the company can operate in accordance with the legislation in force.

Contact us for personalised advice as to the commencement of your company's activity!

-

When will my company be effective and what obligations will I have to fulfil during its activity?

Depending on the region and activity of the company, it will be necessary to carry out certain bureaucratic steps before the corresponding administrative bodies.

Almost all companies, if not all, must carry out all administrative procedures online using a Digital Certificate (Certificado Digital). The concept is simple: it consists of installing an 'electronic ID' onto your computer or tablet so that you can connect to any public body. It is an indispensable tool when it comes to the day-to-day management of your company. If you decide to hire us as your accountants or tax advisers we will ask for you to have a digital certificate because it facilitates all kinds of legal procedures.

Check out the following article for more information about company obligations:

LEGAL AND FINANCIAL OBLIGATIONS OF COMPANIES IN SPAIN

-

Does my business activity have to start as soon as i sign the deed of incorporation with the notary?

The signature of the deed of incorporation at the Notary's office does not mark the beginning of your activity.

In addition to the steps to be taken to form the company, your company will have to declare the type of activity and the effective start date to the Spanish Tax Administration (Agencia Tributaria Española). In order to fulfil this obligation, you will have to electronically submit the form for the census of entrepreneurs and professionals. During the first two years following your activity start date, the Agencia Tributaria also imposes the declaration and payment of the Tax on Economic Activities.

-

What are the basic corporate obligations to accomplish?

Meetings

Another important issue is that your company will be required to carry out an AGM (annual general meeting), along with any other extraordinary meetings as required by Spanish Company Law when there is any substantial change within the company.

With regard to the annual general meeting, the administrative body established in the company's Articles of Association/Bylaws must meet at least once a year, during the first quarter of each fiscal year, for the very specific purposes of voting on and approving the company management and the annual accounts of the previous fiscal year and deciding on what to do with the results of the previous fiscal year's accounts.

Minute Books

The company is required to maintain a book of the minutes of the meetings of the shareholders/partners and administrative bodies, one book for each fiscal year. These books should be legalised yearly at the Commercial Regsitry and updated when there are any amendments related to the shareholders, purchase or sale of shares, or contracts between the sole shareholder and the company, by submitting the corresponding minutes to the Commercial Registry responsable for the region in which the company is registered.

Indeed, we must not forget that the Spanish political system is a decentralized unitary state on a large scale. This means that Spain is divided into 17 Autonomous Communities, themselves divided into provinces, and further into municipalities. The vested in the local authorities allow them to adopt administrative decisions that are specific to their geographical area, as long as they are compatible with "estatal" law (law which is applicable to all of the territories belonging to Spain). Therefore, a company whose registered address is in Barcelona or Cornella will be registered in the Commercial Registry of Barcelona, while a company whose registered address is in Girona will direct itself to the Commercial Registry of Girona, both of which belong to Catalonia.

You might be interested in the following article:

CORPORATE CONSULTANCY FOR COMPANY MINUTES BOOKS IN SPAIN

Our team is made up of highly specialised lawyers and economists.

In particular, Ms. María Teresa Garasa Gil is an expert corporate lawyer who will be happy to support you either in English, French or Spanish with regards to any matter related to commercial law.

Meanwhile, our tax specialist Mr. Alessandro Scherini will be able to accompany you in the constitution of your company in Spain, and advise you on fiscal matters throughout the life of your company.

Do not hesitate to ask them for more information about these steps and their rates for setting up a business in Spain in accordance with Spanish law.

tax and accounting obligations

Which tax and accounting obligations must my company fulfil in Spain?

Starting an economic activity as a company involves a whole set of national tax obligations, some of which must be fulfilled before starting the activity, such as enrolling on the entrepeneurs and professionals census mentioned above, while others will have to be carried out throughout the life of the company.

In general, the first step is the submission of the 036 or 037 form, the so-called "censal" (census) declaration.

Once the activity is started, any income received by natural persons or entities without legal personality is taxed by the personal income tax (IRPF - payments on account and annual declaration). Meanwhile, legal entities are taxed by corporation tax (IS - payments on account and annual declaration).

In addition, obligations related to value-added tax (VAT), informative declarations (for example, with regards to transactions with third parties - form 347, annual summary of incomes and retentions - form 190, etc.) and other mandatory declarations must be completed and declared online.

WHEN DO I HAVE TO PAY TAXES IN SPAIN?

Find out in the above article!

-

How can i INTERACT WITH SPANISH ADMINISTRATIve BODIES?

As a company you will have to use use your digital certificate online to perform any kind of actions with the Spanish administration (for example, to check the notifications they have sent to you, respond to the administrative bodies, complete tax returns, etc.).

-

Is my company obligated to keep its accounts updated?

In Spain accounting is the tool with which the tax expert calculates, prepares and submits the company's tax returns.

It is in that sense that the law imposes on all businesspeople, regardless of their company type (having a natural or legal personality), the obligation to keep accounts in accordance with the provisions of the Commerce and General Accounting Plan Code or with that which is established in the applicable regulation. The Commercial Code requires you to maintain two accounts books:

-

The Daily Book (El libro diario)

In the Daily Book one should chronologically, day by day, record all of the operations carried out in the development of the activity. You can also record total transactions over periods for a month, but details should be recorded in matching books or similar records.

-

The Book of Inventory and Annual Accounts (El libro de inventarios y cuentas anuales)

This book must be opened with the detailed initial balance sheet of the company, retranscribing, at least every quarter, sums and balances and balance sheets. The closing inventory of the financial year and annual accounts must be settled annually.

The last financial statement at the end of each financial year contains the annual accounts: balance sheet, income statement, equity statement of changes, cash flow statement and financial position statement . The annual accounts are the most important accounting instrument for corporation tax, as they serve as a starting point for the configuration of your taxable base.

In addition to the compulsory books, books and records may be kept voluntarily depending on the accounting system adopted or the nature of the economic activity.

There is also an obligation to keep and legalise certain 'business books': the book of minutes, the book of registered shares in anonymous corporations, and the limited shares and registration book associated with limited liability companies.

Bear in mind that it is not enough to just manage accounts and maintain the obligatory accounting books, these accounting books must also be legalised.

Our team is composed of business management agents and highly specialised economists who focus on business and accounting management. For example:

Ms. Eva Serra Ontiveros, specialises in accounting and business law

Our tax expert is Mr. Alessandro Sherini, and

Ms. Cyrielle Agut is our lawyer in social and tax law who can support you in English, Spanish or French when dealing with the accounting and tax management of your company.

Don't hesitate to ask them for more information about these procedures and their management method.

LABOuR LAW - employment law

Under what legal conditions can I hire staff within my company?

-

What formalities do I have to fulfil when hiring? Is it necessary to draft an EMPLOYMENT contract? What is the minimum and maximum duration of a trial period? How SHOULD i terminate the employment contract? Can my employee have multiple jobs?

From our experience, we know that many questions arise when hiring staff and this often makes businesspeople and entrepreneurs feel hesitant.

Having specialist employment lawyers at hand that you can count on is vital because labor law can vary greatly from one country to the next. Regarding Spain, here is a summary of the key points to bear in mind concerning labour contracts, contractual standards, and the main changes that have taken in place in recent years:

First of all, let us not forget the very concept of the employment contract, whereby a person undertakes to personally perform services for a fee, within the framework of an organisation, under the direction of another person and on behalf of the employer. This is what lawyers call the rule of 5:

- Voluntary: No one can be forced or threatened to work for an employer should they refuse. This decision must be specific to the person who will perform the various requested tasks.

- Personal: In the case of hiring, the worker is recruited for his qualities, his experience or his academic career. The position cannot, therefore, be occupied by X if the employment contract was negotiated with Y.

- Remuneration: "all work deserves be paid".

- Subordination: Performance of the job under the authority of an employer who has the right to issue orders and instructions, to supervise the execution of the tasks and to punish failings of subordinate employees.

- On another's behalf : The work is not done by the employee for themselves. They are not liable to third parties.

Due to the relationship of dependency arising from the contract, labour and employment law seeks to protect the employee against the employer's arbitrariness, and it tries to rebalance the relationship between them while also aiming to organise the company to promote employment.

-

Can all professional RELATIONSHIPS be regulated by an employment contract?

In accordance with the above-mentioned rule of 5, certain relationships are totally excluded from the system of the Workers' Statute Law, which is the equivalent of the Labour Code, for the following reasons:

- The freelancers/self-employed persons: they don't respect rule 5, "on another's behalf", since their professional risk is taken on their own behlaf. They are liable to third parties.

- Civil servants and national staff: these relationships are regulated by specific legal and regulatory standards.

- Personal, compulsory work: when, for instance, due a judicial ruling, a person has the obligation to perform tasks related to general interest, and, therefore, the performance of the tasks is not voluntary (rule 1).

- Advisers and managing directors: there is no relationship of subordination since these people act under their own power (rule 4).

- Work done amongst friends, on a voluntary basis or in the neighbourhood: this woudn't be a remunerated activity (rule 3).

- Familial work: this work would not be performed for another's benefit, but for the benefit of one's own family (rule 5).

Certain relationships, by their very nature, will be framed differently and some other particular rules will be applied. They are then treated as special employment relationships, as provided for in Article 2 of Workers' Statute. For example:

- Executive officer.

- Family home service.

- Convicts in penitentiary institutions.

- Professional sportspeople.

- Artists in public spectacles.

- Sales representatives.

- Disabled workers in special employment centers.

- Harbour workers.

- Specialists in health science in training.

- Lawyers working in law firms.

- Religion teachers in public centers.

- Civilian personnel of military establishments.

- Civilian air traffic controllers.

Find out more about our employment and labour law services

-

How does The new obligation to register working hours work?

New regulations settled recently in the Workers' Statute, such as the one of the 12th of May 2019, obligate companies to guarantee daily registration of their employees' working hours by recording the arrival and departure time of all employees, without prejudice to potential flexible timetables.

This type of information can be collected in whichever form the company chooses, but it must respect the sector, the activities and the professional categories of employees.

This information must be kept for a minimum of 4 years from the date of registration and must be available to employees who would like to have access to it. It must also be accessible to workers' legal representatives and the Labor and Social Security Authorities.

-

What is a Gender Equality Plan in a company?

Another current issue in the working world that Spanish legislators have wanted to tackle is that of equal opportunities for women and men in the workplace.

In addition to international and European regulations in this area, the law in Spain recognises equality between women and men as a universal legal principle, offering legal tools to encourage policies to combat gender inequalities, especially in the context of labour relations where witnessing sexual harassment, gender-based harassment or discrimination on the grounds of pregnancy or maternity is not as uncommon as one would hope.

The Organic Law 3/2007, of March 22, established the necessary behaviors and tools required for the realisation of gender equality. In particular, this law specifically defines the concepts of sexual harassment, harassment on the grounds of gender and direct discrimination on the basis of sex:

- Sexual harassment is defined as "any verbal or physical conduct of a sexual nature that has the purpose or effect of violating the dignity of a person, in particular where it creates an intimidating, degrading or offensive environment" for the person subjected to harassment (Article 7.1 of the Law 3/2007, of March 22).

- Gender-based harassment is defined as "any conduct carried out on the basis of sex with the purpose or effect of violating the dignity of a person and of creating an intimidating, degrading or offensive environment" for the person subjected to harassment (Article 7.2 of Law 3/2007, of March 22).

- Direct discrimination on the basis of sex is defined as "any unfavorable treatment of women related to pregnancy or maternity".

The official publication of the Royal Decree 6/2019 of March 1 on urgent measures to guarantee equal treatment and opportunities for women and men marks the introduction of particularly important changes when it comes to the obligation of companies to implement an equality plan. This regulation provides progressive application of this measure, as follows:

- From the 7th of March 2020 all companies with more than 150 employees will be obligated to implement this equality plan.

- From the 7th of March 2021 all companies employing between100 and 150 employees will be obligated to set up this equality plan.

- From the 7th of March 2022 all companies employing between 50 and 100 employees will be obligated to set up this equality plan.

This Plan must fulfil the minimum content requirements established by the same Royal Decree, as well as involving preliminary negotiated diagnosis of the current situation, with the legal representatives of the workers, if applicable.

In order to ensure the viability of this internal regulation of the company, it will be necessary for the company to establish the measures which are to be impemented, i.e. an action plan must be drawn up. Among the actions to be taken, an easy and accessible tool for all employees would be the implementation of an anti-harassment protocol, which includes corrective measures to be implemented should harassment or discrimination occur.

For more information, check out the following article:

GENDER EQUALITY PLAN AND MEASURES TO BE ADOPTED

-

pREVENTION of work-related accidents:

The duty to avoid accidents can be found in the Law on Prevention of Occupational Risks which establishes the main obligations for preventing accidents:

- Identification of the risk of accidents.

- Preventive action planning.

- Training and information on the risk of accidents

- Personal protective equipment

- Health checkups.

These and other more specific obligations are outlined by the Labour Authority, especially in the case of an accident actually ocurring in the workplace.

Check out this page for more information from us on workplace accidents

-

What are the possible causes of a contract ending?

The termination of the employment contract can be justified by one of these reasons:

- An employee's own decision: this is the really common cause of contract termination (respecting the notice period laid out in the employment contract or in the collective agreement applicable to the employment contract). In the case of serious misconduct on the part of the company, the employee is entitled to claim compensation. This can also be done in cases of withdrawal during the probationary period, when leaving the job, or in the case of female victims of gender-based violence.

- On agreement by both parties: the contract itself may expressly provide different legal grounds for termination, such as the expiration of the contract, for instance.

- For reasons beyond the parties' control: for instance, the Workers' Statute states that in case of the death of one of the parties (employer or worker), the employee's retirement or the declaration of his or her permanent disability (total or absolute), or disability, the contract expires.

- Employer's own decision: when the company decides to dismiss his or her employee through one of the legal routes, such as disciplinary dismissal, objective causes dismissal, force majeure, collective dismissal, or the extinction of the legal personality of the employer's company.

More information can be found in the following article:

-

Should disputes arise, what steps should be taken and with which organisation?

Mediation and the necessity to attempt extrajudicial agreement are Alternative Dispute Resolutions which are in force in the Spanish legal system, encouraging solutions to be found amongst society. Extrajudicial public institutions from the autonomous administrations favour these non-contentious dispute resolution methods.

Because of this, there exist several instruments whose aim is to avoid conflict in courts, and sometimes these are optional, sometimes they are mandatory, depending on the type of dispute and its context.

For this purpose there are, for instance, some agreements that are borne out of the maintenance and development of an autonomous system for solving the collective social conflicts which can arise between employers and workers and their representatives. These are sometimes voluntary, sometimes mandatory, and they call for trade unions such as UGT, CCOO, CEOE and/or company unions like CEPYME o FOMENT to reach agreements known as Autonomous Dispute Resolution Agreements (Acuerdos de Solución Autónoma de Conflictos). These types of agreements are regulated by the Resolution of 10/02/2012 of the Directorate General of Employment.

Another form of extrajudicial dispute management is that which is provided for through the administrative conciliation mechanism. This procedure is to be carried out before subscribing almost any kind of judicial claim in front of Social Courts, because, otherwise, the Court application will be rejected. The purpose of this approach is precisely to try to achieve a pre-judicial agreement between the parties in situations such as dismissals, substantial changes in working conditions, claims, etc. In those cases the Social Courts will always have to verify the existence of this attempt at conciliation, requiring the conciliation certification act. The 'papeleta de conciliación' will have to be handed over to the conciliation administrative body of the place where services were supplied, or of the person concerned's address, the choice as to which is to be made by the person who is making the conciliation request.

Once the 'papeleta' has been admitted, the parties will be summoned to appear in front of the public administration that is in charge of conciliations' management. The parties may represent themselves or they can use a representative, who would most commonly be a lawyer or a 'social graduate' (legal advisor in socio-labour matters). It is important to know that the absence of the person making the claim will cause the proceedings to be terminated and the initiating file to be archived.

Specialists in litigation, labour law and social security in Spain since 1976, our team is made up of lawyers registered at the Barcelona Bar Association (Ilustre Colegio de Abogados de Barcelona) who are just as capable of defending the employer as the employee.

If you place your trust in us, you could be represented by Mr. Josep Conesa Sagrera, lawyer and CEO of CONESA LEGAL who will also be able to advise you in English; by Ms. Zaida Álvarez, specialist lawyer of labour law, collective dispute dismissals specialist; by Mr. Albert Perez, specialist lawyer of labour law and human resources; by Mr. Lluís Prat Yague, specialist lawyer of labour law and social security; or by Ms. Cyrielle Agut, specialist lawyer of social and tax law who can also advise you in either French, Spanish or English.

Do not hesitate to ask us for any further information or arrange a meeting if you would like to explain your issue to us.

If you want to take a look at an English version of the Spanish Worker's Statute you can download one via the following link:

Link to download Spanish Worker's Statute

spanish national insurance: social security

As an employer, what are my obligations regarding the Spanish Social Security?

As in any so-called 'welfare' state, the Social Security organisation supervises the companies who have the obligation to register any kind of changes, either of the company itself, or of its employees. According to the Spanish administrative system, the steps that a company must take with regards to Social Security are accessible only by forms and models available online.

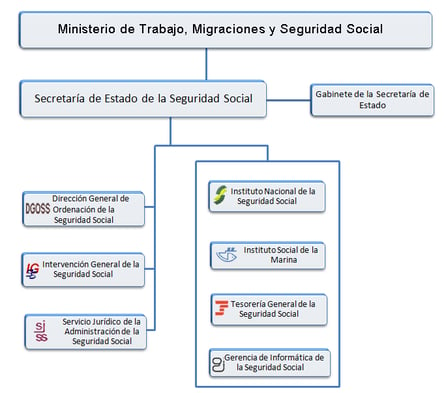

To help you understand the Social Security system's organisation, please see the summary diagram below:

-

Does my company qualify to hire staff?

First of all, it is important to specify that the term 'employer' can be used for any natural or legal person, public or private, on whose behalf salaried workers or employees provide their services, provided that these persons are included in one of the contribution schemes set up by Social Security. This is the case even if the activity of the employer is not motivated by a profit.

The employer's enrollment within the Spanish national Social Security system is an administrative act by which the General Treasury of the Social Security gives an identification number, called a Contribution Account Code (CCC) to the company, and this allows it to fulfil its obligations with the Social Security Scheme.

The entrepeneur will have to apply for the CCC in the geographical area in which the he or she will hire the employees which can then be directly linked to his main CCC, allowing him or her to link all of the activities carried out on the Spanish territory. In addition, Social Security may also require the employer to apply for a CCC in specific cases for special workers' relationships for which the contributions may be different.

As mentioned above, the company's registration process as an 'employer' falls within the jurisdiction of the Administration of the General Treasury of the Social Security closest to the registrered address of the company's activity. This request can be submitted electronically through the use of the company's digital certificate.

In any case, if the company is just starting out, before hiring workers, the employer must first apply for his or her registration before starting his activity. Indeed, should the company not register, it will not be possible to legally hire employees and make the necessary Social Security contributions on behalf of the company and the employees.

As such, the registration application must include the following documents:

1.- In the case of an individual entrepreneur:

- Official application form.

- Identification document of the owner's company as an individual entrepreneur (or the head of the family in the special case of the domestic employment).

- Proof of Economic Activity of the Company issued by the Ministry of the Economy and Taxes which assigns a tax identification number (this proof is not required when hiring domestic workers).

- In the case of collective entrepreneurs and Spanish companies:

- The first three documents cited above.

- Notarised Deed of Incorporation, duly registered or corresponding certificate of registration (Book of Minutes for Condominiums).

- Photocopy of the ID of the person applying for the registration, as well as the notorised act of the person signing the application for its registration.

- In the case of collective entrepreneurs and foreign companies:

- In the case of establishing a workplace in Spain: the documents previously indicated for branches and companies transferring their registered address to Spain.

- In the case of not establishing a workplace in Spain: the documents indicated in the first section, photocopy of the notarised Deed of Incorporation of the foreign company with certificate of registration in the corresponding register of companies or equivalent required by the legal standard for companies in the European Union. If the company was incorporated in a non-U.E. country, it will be necessary to present a certificate from the Spanish Consulate of the corresponding country stating that the company in question was incorporated under the law of that country.

- In both cases, the company must be legally represented by a natural person whose address is in Spain.

-

Which steps do I need to take IN ORDER to hire employees?

Are you planning to start advertising positions at your company? Remember that before taking any steps, the company must be declared and registered at the General Treasury of the Social Security of the province where the employee will carry out their work.

Regarding the paperwork, this will have to be completed electronically, taking care to meet any deadlines for registration, updating details on terminations, modifications of employees' data and salaries of all employees enrolled at the company. Social Security has set up an online electronic network system for professionals and businesses, accessible with your digital certificate, so that you and they can supervise the content of your files.

For as long as the employment contract between the employee and your company remains in force, you are required to respect the social security obligations derived from the contract. It will not be until the contract is terminated that the obligation to pay benefits and employer contributions will disappear, and the termination of this contractual relationship will also need to be communicated within the legal deadlines.

-

contribution timeline: start, duration and end of the obligation to contribute to social security

As previously stated, a salaried activity brings about the obligation to pay social security contributions, starting from the moment the worker is enrolled in your company.

However, beware that if there is a relationship of employment, not submitting the application to register the employee does not in any way avoid the obligation to contribute to social security obligations. With that in mind, the General Treasury of the Social Security may ask the company to pay any missed contributions from the last 4 years.

As mentioned above, this obligation disapears when the employment contract comes to an end and this is communicated to the authorities. However, the obligation to make contributions will remain in the following cases

- Sick leave.

- Risk during pregnancy and risk during the breastfeeding period.

- Maternity leave and paternity leave.

- Performance of public duties.

- Carrying out the duties of a trade union's representative (conditioned to not taking a leave or ending the contract).

- Special conventions.

- Contributory unemployment.

- Social unemployment.

- Licenses and authorisations when they don't give right to a leave of absence.

- In particular cases as established by each type of social scheme.

-

What happens in the event of unpaid contributions to spanish national insurance?

In the event of unpaid contributions, the Social Security Administration will register a debt in their records resulting from the non-payment of the contributions.

In addition, the Administration will require the outstanding amount to be paid and begin the process of seizure.

-

What is the base sum for the contribution calculations?

The contribution base in the different schemes of the Social Security system is composed of the total remuneration of the worker, regardless of his or her title and type of work.

The contribution base cannot, under any circumstances, be higher than the maximum limit legally established and fixed by the annual Law of General Budgets of the State. This maximum amount is applicable to all types of activities and or occupational categories, regardless of the number of worked hours.

In contrast, the legal minimum amount of the contribution base is that of the Minimum Interprofessional Salary currently in force, increased by one-sixth.

- Meal expenses and travel expenses, or transportation.

- Compensation for death, removals, suspension of contract and dismissals.

- Expenses for hand tools, or acquisition of work clothes.

- Products in kind granted voluntarily by the employer.

- Wedding gifts.

- Social security benefits, improvements and social benefits granted by companies.

- Overtime, excluding contributions for workplace accidents and occupational illness.

The calculation of the monthly contribution base is divided into two subgroups:

- Common contingencies: including monthly remuneration, as well as proportional parts of extraordinary payments and any concept of higher remuneration other than the monthly salary.

- Occupational and other contingencies (unemployment, vocational training and wage guarantee fund): the previous rules are applied, but the extraordinary hours will be taken into account.

-

Which organisation do I have to deal with to fullfil my paperwork?

- Enrollment of CEOs and managers into the social security schemes: The General Treasury of Social Security.

- Registration of the company: The eneral Treasury of Social Security.

- Affiliation of employees: The General Treasury of Social Security.

- Registration of workers in the corresponding Social Security Scheme: The General Treasury of Social Security.

- Registration of employment contracts: National Public Employment Service.

- Communication of the opening of a centre of work: Autonomous Community Worker's Administration.

- Obtaining the work schedule: Provincial Labor Inspection.

In order to offer you complete support, in addition to legal advice, our Personnel Management Department GESOFFICE specialise in doing all of the paperwork required by Social Security and they can explain and manage all of this for you, allowing a smooth transition through the previously mentioned steps.

We advise on, draft and communicate contracts, enroll employees into the Social Security system, as well as preparing payslips and adaptating payrolls and contracts to legislative changes and renewals of Collective Agreements.

Do not hesitate to contact our Social Security department GESOFFICE, composed of Mr. Lluís Prat Yagüe, a lawyer specialised in labour law and social security, Ms. Judith Montañés Partal who has a Human Resources degree and is a specialist in social management, and Ms. Marta Vilar Saura, a legal assistant specialising in social security management.